In an EY podcast on Why “cash culture” is a critical lever in today’s PE climate, Nick Boreo from EY Strategy and Operations Services spoke out on the importance of cash, particularly during an economic downturn.

“Where most companies think about cash flow is actually getting back to the fundamentals of running a business. In the current environment, cash and working capital is the cheapest source of liquidity a business can generate,” he declared.

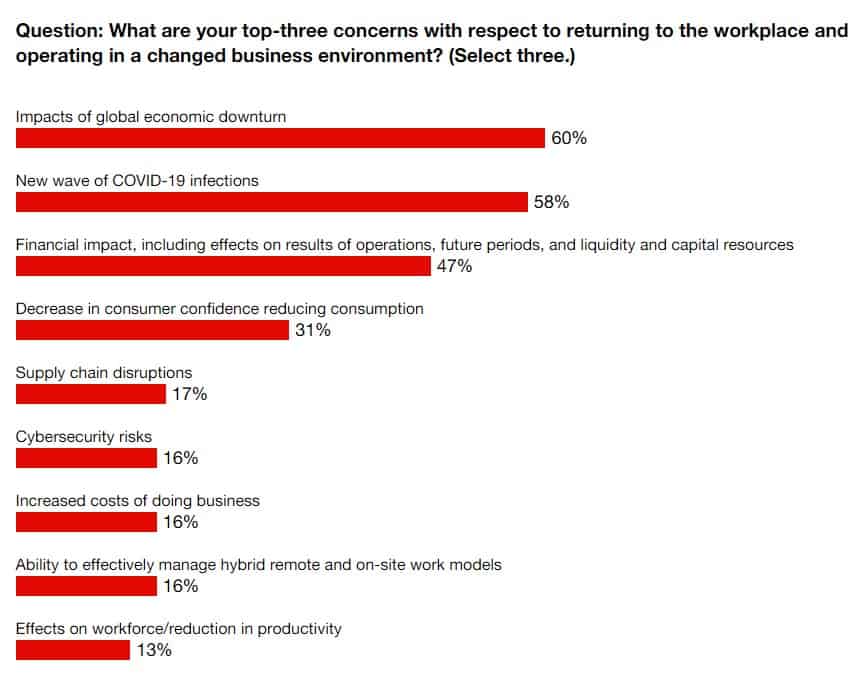

During the early days of the pandemic, a PwC Pulse survey revealed that liquidity and capital resources were among the top concerns of 47% of CFOs surveyed.

Accounts receivables measure the money that customers owe to a business for goods or services already provided. Analysing a company's accounts receivable will help investors gain a better sense of a company's overall financial stability and liquidity.

In the Sidetrade “Cash Culture Pulse” 2022 survey of international firms across the UK, Europe, US, Asia and the Middle East, only 17% acknowledged using only Excel for processing accounts receivables (AR). That may well be the good news. Among the 149 businesses that participated in the survey, 77% still use spreadsheets as part of AR.

A strategic priority for cash & credit management

While 61% of finance departments are not taking full advantage of new technologies, this trend is expected to change in the coming years, as 79% of respondents say Artificial Intelligence and automation will be a strategic priority to generate cash faster and more efficiently.

In the fallout from the pandemic, cash culture has been positioned higher on business leaders’ agendas, as companies look to secure and accelerate cash flow generation and establish a 360° vision on the whole Order-to-Cash cycle. This paradigm shift provides seamless collaboration among Finance, Sales and Support functions and ensures that Finance has the best technologies available.

Sidetrade CFO, Philippe Gangneux, opines that spreadsheets have an increasing number of limits and complexities. He claims that there remains a whole host of other ways in which spreadsheets prevent finance leaders from reaching their potential; they limit an organisation’s ability to instil a cash culture, they don’t provide any intelligent recommendations, and they cannot promote data centricity and visibility across the business.

“The crisis we have been through has revealed the importance of securing cash flows, and more and more financial leaders are recognising the benefit of working with a dedicated technology for enhanced Order-to-Cash performance,” he continues.

Reluctance to let go of spreadsheet

Gangneux acknowledges that spreadsheets certainly still have their strengths and their place in the business world in many ways; it’s simply that when it comes to cash flow management, they no longer offer up the same benefits that other, more advanced technologies do.

“The reluctance of finance executives to abandon spreadsheets entirely and head towards more intelligent AI-powered solutions reminds me of the saying “you don’t know what you don’t know”. If executives haven’t had the opportunity to see for themselves the benefits that more advanced technologies and AI can deliver for them, then it can be all too easy to stick their heads in the sand and assume that they’re getting the best possible Order-to-Cash results from their incumbent technologies,” he adds.

He comments matter-of-factly that spreadsheets cannot give businesses the same advantages that dedicated AI Order-to-Cash solutions can when it comes to cash flow management.

“Writing simple macros, eliminating duplicates, building pivot tables, extrapolating data and creating basic graphs all still make it a most lucrative tool, but not efficient enough for delivering round-the-clock and up-to-date information on cash and credit management,” he continues.

He argues that what is essential is for CFOs to recognise the importance of using the solution that best fits the “shape” of their cash culture challenges and the way it needs to be analysed.

How does this tie into the cash culture that the Sidetrade report reveals?

According to Gangneux, the harsh reality is that executives’ reluctance to move away from spreadsheets in their Order-to-Cash efforts is having a detrimental impact on their overall cash culture ambitions.

Citing the company’s Cash Culture Pulse 2022 study, he points out that not only is there a high dissatisfaction rate among businesses towards spreadsheets for cash flow management.

In particular, it is through use of spreadsheets is suggested to lead to a higher number of unpaid invoices: 42% of finance teams still heavily reliant on spreadsheets reported a high ratio of late payments overall (15%).

“Conversely, this number was almost halved (22%) for finance teams that use a dedicated cash and credit management software,” he implied.

What is holding up automation?

Gangneux opines that the hold up in the quest to move away from spreadsheets in cash flow management is a lack of realisation amongst finance teams around just how damaging the continued use of the tool is for delaying a CFO’s cash flow and cash generation goals.

“CFOs are data-driven, and they need to be convinced that their efforts in a digital transformation project will drive beneficial ROI,” he continues. “Therefore, it’s so important that technology vendors take the unique approach to build and demonstrate a solid ROI for all their prospects before they buy our product or services.”

Greater adoption of automation software

Gangneux argues that driving greater adoption of automated and AI-powered solutions is all about being able to demonstrate a clear and robust ROI with data and insights for the CFOs – for example, what DSO impact the solution can have, time to dispute resolution, reduction in overdue invoices, or any other KPI that the solution is intended to provide.

He believes that the priority for any technology vendor – whatever product or service they’re offering – should be to demonstrate exactly what their customer will be able to gain from taking on their solution.

“Ultimately, this all comes down to data because no CFO is going to willingly adopt a new solution without first having a clear view of what it can achieve for them, and a quantifiable measurement of how much the solution can solve for them,” he comments.

Changing the mindset

Gangneux goes on to say: “You’re probably bored of hearing this answer now… but ultimately to get leadership to change the culture and mindset around cash and the dependence on spreadsheets is in data, data, and more data.”

He adds that having one single source of information centralised across not only finance teams, but also sales and customer services is an important factor in shifting mindsets.

“Having this centralised source of information available to all has several benefits including visibility, enhanced collaboration and an alignment of goals,” he adds.